SDFI and Petoro annual report 2012

Contents      | |||

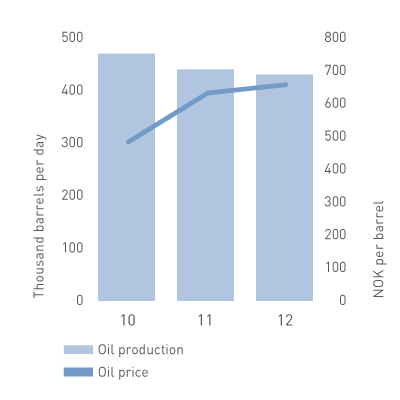

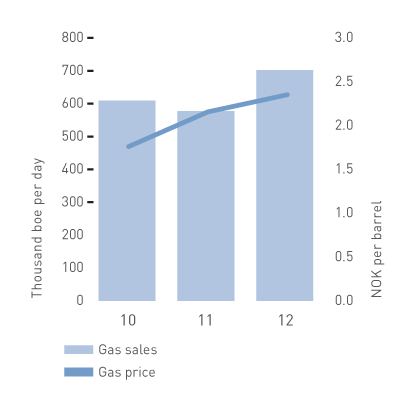

Marketing and sale of the productsAll oil and NGL from the SDFI portfolio is sold to Statoil. The latter is responsible for marketing all the SDFI’s natural gas together with its own gas as a single portfolio, but at the government’s expense and risk. Petoro is responsible for monitoring that Statoil’s sales of the SDFI’s petroleum achieve the highest possible overall value, and for ensuring an equitable division of total value creation. Petoro concentrates in this work on Statoil’s marketing and sales strategy, issues of great significance in value terms, matters of principle and questions relating to incentives. Oil prices were particularly influenced during 2012 by two factors – weak global economic growth on the one hand and geopolitical conditions on the other. Weak growth helped to keep the rise in oil demand below the historical trend, while geopolitical tensions contributed to reducing world crude output and thereby to keeping prices relatively high. With brief exceptions, oil prices moved within a band of USD 100-120 per barrel. The average figure for 2012 was USD 113 per barrel compared with USD 114 in 2011, or NOK 657 and NOK 632 per barrel respectively. | OIL PRODUCTION/PRICEEuropean demand for gas declined by about four per cent in 2012, with developments varying by plus/minus five per cent between the different countries. Foreign sales of Norwegian gas increased by 16 per cent, while Russian exports fell by eight per cent. Part of the gas volume sold to Europe is priced in accordance with market quotations which reflect the balance between supply and demand (spot pricing). Spot prices in the European gas market were stable during 2012 and marginally higher than the year before. The average gas price for the SDFI portfolio in 2012 was NOK 2.35 per scm, compared with NOK 2.15 the year before. About 65 per cent of the SDFI’s gas production was sold under long-term contracts at 31 December, with the rest sold in the spot market. Gas prices in the long-term contracts are primarily calculated in relation to the price of oil products and quotations in the gas market. | Crude prices again helped to maintain a differential between oil-indexed contract prices and spot prices for gas in 2012. This position led to pressure on the level of prices in the long-term oil-indexed contracts. Petoro has worked to ensure maximum value creation for the gas portfolio, including realisation of the value potential in the long-term sales contracts. The company is concerned to ensure that available gas is sold in the market at the highest possible price, and that the flexibility of production plants and transport capacity is exploited to optimise deliveries. Petoro also monitored and assured itself that petroleum sales to Statoil’s own facilities are made at their market-based value. In addition, checks were made to ensure that the SDFI was being charged an equitable share of costs and received its equitable share of revenues. GAS SALES/PRICE | |