The SDFI scheme was established in 1985. Under this arrangement, the state participates as a direct investor in petroleum activities on the Norwegian continental shelf (NCS), so that the state receives revenues and meets expenses associated with SDFI's ownership interests. As SDFI manager, Petoro contributed a cash flow of nearly NOK 66 billion in 2016, which represents a significant portion of the state's total revenues from the petroleum activities. Petoro acts as licensee for the state's ownership interests in production licences, fields, pipelines and onshore facilities, and manages this portfolio based on sound business principles.

External trends

Global economic growth in 2016 was around 3 per cent, which was in line with expectations. In combination with weak oil prices, this contributed to continued growth in global demand for oil, around 1.4 million barrels (bbls) per day in 2016. The price of oil fell below USD 30 per barrel (bbl) in January 2016, but rose substantially towards the summer, based on an expected rebalancing in the market. However, this rebalancing has taken longer than first expected. Despite regular announcements from OPEC countries concerning the necessity of production cuts, production from both OPEC and Russia was higher, while the decline in US shale oil production levelled off. In November, OPEC adopted an agreement mandating production cuts of 1.2 million bbls per day, with the support of certain non-OPEC countries such as Russia. This helped facilitate a stabilisation of the oil price towards the end of the year at around USD 55 per bbl, which was nearly double the price at the beginning of the year. The average price for the year was Norwegian kroner (NOK) 361 per bbl, down NOK 59 from 2015.

European demand for gas in 2016 was somewhat higher than the previous year. The increase was partly a result of lower temperatures, but also higher demand from the power sector in several European countries. Power prices rose in the autumn of 2016 as a consequence of the shutdown of several nuclear power plants, which also contributed to bolster profitability for gas power plants. A significant increase in coal prices was also a contributing factor in improving the competitiveness of gas in the power sector. Russian gas exports to Europe reached record levels in 2016, while LNG imports were lower than expected. Norwegian gas exports remained at approximately the same level as the previous year. Ample gas supplies caused considerable pressure on prices in Europe throughout the year. Prices below NOK 1 per Sm³ were quoted in August. Prices rallied towards the winter resulting from factors such as low temperatures and increased demand from the power sector. The average gas price achieved for the portfolio was NOK 1.62 per Sm³ in 2016, compared with NOK 2.14 per Sm³ in 2015.

A more negative scenario has emerged throughout 2016 as regards long-term demand for both oil and gas. The Paris Agreement was ratified in November and lays the groundwork for a levelling, and ultimately declining, demand for fossil fuels. The EU has confirmed its ambition to achieve comprehensive decarbonisation over the longer term. This commitment places particular focus on energy efficiency – in addition to renewable energy – as important components in reducing consumption, particularly of gas.

As a response to Norway's climate commitments, the industry has worked with the Norwegian Oil and Gas Association in 2016 to establish a road map leading up to 2030 and 2050. This road map includes concrete and ambitious reduction targets for emissions from production and maritime activity on the Norwegian Shelf. The industry will work systematically to develop and implement an operating philosophy along with technology that fosters emission reductions. Examples of proposed measures include low-emission solutions in new projects and energy efficiency measures in existing facilities.

The comprehensive adjustment that the oil and gas industry has undergone in recent years has yielded results. Major cost reductions have been achieved in both operation of facilities and in new projects. Substantial efficiency improvements have also been made, for example in drilling progress and regularity. This development paves the way for new, profitable projects on the Norwegian Shelf. However, the situation is still characterised by significant uncertainty regarding the future price development for oil and gas, profitability and competitiveness. The industry has cut back its investment plans, both in Norway and globally. As a result, further activity linked to development of new production capacity on the Norwegian Shelf is expected to stabilise at a lower level than previously.

A strong driving force in this transformation has been the need for rapid cash flow improvement. The improvement efforts have been aimed at reduced activity, cost/benefit assessment of measures, streamlining and standardisation of solutions and work processes, better planning and renegotiation of contract rates. Further streamlining and initiatives are needed to reduce cost levels and improve profitability in the sector, both short-term and long-term. The potential is great through application of new technology, improved cooperation between players in the supply chains and new operating models. Such measures will entail a comprehensive change in the way the industry works, which means that implementation will take time. Such measures will entail a comprehensive change in the way the industry works, which means that implementation will take time.

Summary of SDFI results

The financial result for 2016 was a net income of NOK 57 billion, NOK 32 billion lower than in 2015. Cash flow to the state was NOK 66 billion in 2016, 30 per cent lower than in 2015.

Significantly lower oil and gas prices in 2016, compared with 2015, impacted both the cash flow and the financial result for the year. Total production was 1 040 000 bbls of oil equivalents (o.e.) per day. Production was 3 per cent lower than in 2015, primarily due to lower gas production. The high gas production in 2015 was due to shifting gas volumes from 2014 to 2015. Regularity remained good in 2016.

Investments in 2016 amounted to NOK 28 billion, which is the same level as the previous year. Production drilling accounts for approximately one-half of the investments.

The book value of assets at 31 December 2016 was NOK 241 billion. The assets consist of operating facilities related to field installations, pipelines and onshore plants, as well as current accounts receivable. Year-end equity was NOK 153 billion.

Principal activities in 2016

As of the end of 2016, the portfolio consisted of 180 production licences, 6 more than at the beginning of the year. In January 2016, Petoro was awarded participating interests in 13 production licences in predefined areas (APA 2015). In the 23rd licensing round in May 2016, Petoro was granted participating interests in 5 production licences, all in the Barents Sea, where two exploration wells are expected to be drilled in 2017. Petoro also received participating interests in 13 production licences in predefined areas (APA 2016) in January 2017.

The company's strategy was revised in 2016. Through focused follow-up, supported by in-depth professional commitment, Petoro will reinforce value creation opportunities with emphasis on long-term business development. This is a two-part strategy: Increase the competitiveness of the portfolio and realise value in mature fields.

The board considers the company's climate policy, which was established in 2016, as a step toward realising the strategy. The policy emphasises Petoro's contribution to ensuring that the oil and gas industry on the Norwegian Shelf leads the way in addressing climate challenges.

The main effort exerted by the company aims at influencing decision processes in the licences. Petoro is also a driving force for improving and further developing activity on the Norwegian Shelf through active dialogue with the industry, based on own analyses.

Production from mature oil fields continues to dominate oil production in the SDFI portfolio. Troll, Åsgard, Oseberg, Heidrun, Snorre and Gullfaks accounted for 60 per cent of total liquids production. Approximately 70 per cent of the gas production came from Troll, Ormen Lange and Åsgard. In 2016, gas accounted for 61 per cent of overall production.

In keeping with the strategy of realising value in mature fields, particular effort has been devoted to Snorre, Heidrun and Oseberg in 2016.

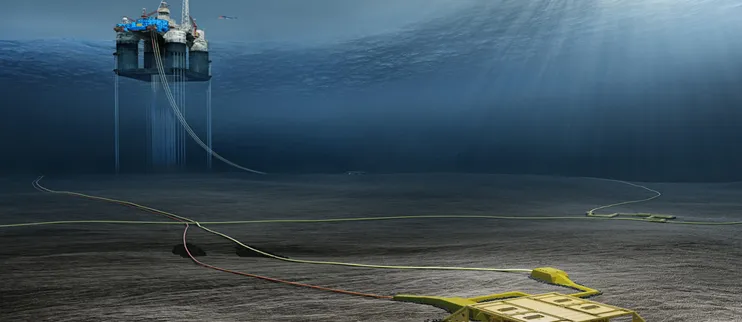

For many years, Petoro has been a strong advocate for realising profitable reserves on Snorre. These efforts have mainly been aimed at reinforcing the reserve potential, and have contributed to a December 2016 licence decision to continue a further development project based on a seabed solution that will provide for 24 new wells. An investment decision is planned in 2017, with production start-up in 2021. This expansion project will facilitate the realisation of significant remaining values in Snorre.

On Heidrun, Petoro has used its own simulation studies to increase understanding of the reservoir, and has contributed to increased basis reserves on the field. A concept selection for Heidrun lifetime extension was made in 2016, and this will facilitate long-term maturing of reserves. The efforts have largely focused on establishing a robust resource base for further development of the field, with particular emphasis on the northern parts.

Petoro's efforts on Oseberg in 2016 have focused on increasing the resource base and thus laying the groundwork for new investments in the "Oseberg further development" project.

Work got under way in the Troll licence in 2016 to assess the possibility of producing the gas cap in Troll Vest (Troll phase 3). Petoro has contributed to the scope and timeframe for the work to ensure a comprehensive approach to further development of the Troll field.

Johan Sverdrup phase 2 and Johan Castberg are two major projects currently in the planning stages. Petoro's focus in 2016 has been on contributing to improved profitability and future-oriented development solutions that will allow sound further development in the operations phase. A decision to continue project planning was made for Johan Castberg in December 2016 with a production ship as the development concept. An investment decision is planned in the licence in 2017, with production start-up in 2022.

One plan for development and operation (PDO) with SDFI participation was approved in 2016: Oseberg Vestflanken 2. A PDO was also submitted to the authorities for Dvalin (PL 435) in October 2016. Petoro became a licensee in December, following takeover of a 35 per cent participating interest in the licence. The plan is to develop Dvalin with tie-in to Heidrun and gas transport via Polarled and Nyhamna. The authorities approved the PDO in January 2017.

The need for streamlining and cost reductions within the drilling and well service area has been an important issue for Petoro over several years. As part of this effort, Petoro has monitored the development in drilling pace on 10 fixed installations on 5 selected fields in the portfolio. For this selected sample, the number of wells has doubled and drilling costs per well have been cut in half over the last three years. This result can mainly be attributed to increased drilling efficiency, simplified well design and increased availability of drilling facilities.

As part of the strategy, Petoro has focused on enhancing the competitiveness of the portfolio. Consistent improvements have been achieved in all areas in the value chain, as illustrated by reduced investment estimates totalling NOK 15 billion (SDFI share) for the three major new projects: Johan Sverdrup, Johan Castberg and Snorre expansion. Recoverable resources for these major new projects are virtually unchanged, which means that competitiveness has increased, and provides a better basis for maturing profitable new projects in the portfolio. Another example of the results of improvement efforts is the 24 per cent reduction in field costs for producing fields since 2013.

Petoro works continuously to ensure that measures implemented to reduce costs are sustainable in both the short and long term perspective, and that they entail actual efficiency improvements, not just reduced activity.

Petoro is concerned with ensuring that the substantial rig capacity committed to the SDFI portfolio is utilised in value-generating activity in the licences and not left idle. There is still a considerable need to drill new wells in mature fields in order to realise the value potential, and drilling makes up a considerable share of investments in long-term prognoses.

Following a number of years of high exploration activity, 36 exploration wells were drilled on the Norwegian Shelf in 2016, down 20 from the year before. Petoro participated in 12 of the exploration wells completed during the year. A total of 5 new and generally minor discoveries were made in the SDFI portfolio; 4 of which are considered to be commercial. The largest is the gas/condensate discovery Herja, northeast of Martin Linge, with a preliminary resource estimate between 2 and 11 million Sm3 of recoverable o.e. The plan is to produce these volumes from Martin Linge.

At the end of 2016, the portfolio’s anticipated remaining reserves of oil, condensate, NGL and gas amounted to 5968 million barrels of oil equivalent (boe). This is down 308 million boe from the end of 2015. The reduction in SDFI portfolio reserves is mainly attributed to production, in addition to the fact that there have been no major development decisions in 2016.