Goals achieved and results

Reference is made to the letter of assignment to Petoro AS for 2015, and to the business plan for Petoro AS. The targets set in the letter of assignment and Petoro’s performance in relation to these are presented below.

Operational targets

Petoro will establish operational targets with the aim of maintaining a high level of production in 2015.

Total liquids production averaged 411 000 b/d in 2015, 16 000 b/d above the target of 395 000. Good drilling progress and high production efficiency (PE) contributed to this performance. High PE reflected in part the deferment of/reduction in modification and maintenance work, including an increase in the interval between planned maintenance turnarounds from three to four years.

Overall production averaged 1 068 000 boe/d, up by about seven per cent from 2014. That primarily reflected higher PE and the completion of more wells. Some gas production was also transferred from 2014 to 2015.

In addition to ordinary licence follow-up, where the operator and partners set production targets and the operator is challenged over nonconformity management and compensatory measures, Petoro’s commitment was directed particularly at measures to increase drilling efficiency. This represents an important instrument for implementing the planned drilling programme and for maintaining high production.

Petoro will establish operational targets aimed at increasing the maturation of reserves through measures to improve recovery from mature fields and to develop new discoveries.

The SDFI portfolio at 31 December comprised 34 producing fields. A number of measures have been identified to improve recovery and thereby increase reserves for these fields, including the choice of good solutions for long-term field development, drilling more wells per year and more efficient drilling.

The SDFI portfolio comprised 6 276 million boe in estimated remaining reserves of oil, condensate, NGL and gas at 31 December. Reserves increased substantially over the year, primarily as a result of the development decision for Johan Sverdrup. The overall rise in the portfolio for the year was 520 million boe. A total of 390 million boe was produced in 2015, giving an estimated net reserve replacement rate of 133 per cent. The comparable figure in 2014 was 24 per cent.

The industry experienced a sharp rise in costs over a number of years, and this trend was unsustainable. That prompted a commitment to cutting costs. In recent years, large oil companies have shifted their business goals away from volume growth and in the direction of financial parameters such as cash flow and dividend. That has led to stricter priorities for investment funds and increased requirements for profitability in new projects. As a result, projects intended to contribute to maturing reserves have been halted, deferred or narrowed in scope. That will contribute to the postponement and reduction of future additions to reserves and production.

Petoro made a special commitment in 2015 to realising the reserve base and additional resources in mature fields, and was a driving force in maturing good and profitable further development projects on Heidrun, Snorre and Oseberg among others. The company’s commitment was particularly concentrated on identifying and establishing the likelihood of meeting the total remaining requirement for wells, increasing the pace of drilling in order to drill all profitable wells within the economic lifetime of the fields, and reducing well costs so that more wells become profitable. Directed at a selection of fields, these efforts are described in more detail under the coverage of mature fields in the section on priority targets and activities.

Furthermore, Petoro worked in 2015 to secure new profitable field developments which have the flexibility to take care of future opportunities, with a particular focus on Johan Sverdrup and Johan Castberg. Where the first of these fields is concerned, the commitment has been directed at promoting an integrated development. Petoro has also contributed to maturing and making provision for the use of advanced injection techniques which can improve recovery from early in the field’s producing life. See also the coverage of Johan Sverdrup in the section on priority targets and activities.

Petoro will establish operational targets with regard to keeping costs at the lowest possible level.

Petoro continued to direct the industry’s attention during 2015 towards the need to speed up the pace of drilling through improved efficiency and cost reductions in the drilling and well service area. The company has followed up progress with the pace of drilling from 10 fixed installations on five fields over several years, and has seen a doubling in the number of wells over the past two years along with a halving in drilling costs for each well.

Growing attention was paid by Petoro in 2015 to the need for improved efficiency also in development, operation and maintenance. The company worked to ensure that the measures adopted are sustainable in both short and long terms, and mean a genuine enhancement in efficiency rather than simply a reduction in activity. The aim is to increase competitiveness and thereby ensure the profitability of investment in mature fields and new developments.

Petoro was particularly involved during 2015 in following up field costs in the licences – in other words, that part of operating expenses which relates largely to offshore operation and maintenance. The company has established targets for these costs related to nine selected fields, and has observed that they were substantially lower for this group in 2015 compared with the 2013 level.

Restructuring measures by the operators have also led to substantial reductions in operational modifications.

Investment in 2015 totalled NOK 28 billion, down by NOK 8 billion or 22 per cent from the year before. This decline was in line with expectations and primarily reflected lower capital spending on development and operations as a result of reduced project activities.

Petoro will establish operational targets aimed at protecting safety and environmental considerations in the petroleum sector.

The general improvement in HSE results is continuing, but was overshadowed by the fatal accident of 30 December 2015 on the

COSL Innovator drilling rig, which was working on the Troll field. The serious incident frequency declined from 0.7 per million working hours in 2014 to 0.5. The personal injury frequency also made progress, falling from 3.8 in 2014 to 3.3. No large individual discharges of oil to the sea or on land occurred in 2015.

Major restructuring and change processes in the industry are influencing the risk picture, and Petoro paid particular attention to this aspect during 2015 when following up HSE and technical integrity. Special attention was again devoted during the year to major accident risk. The company also participated in a number of HSE visits by management to selected fields and installations in 2015. No negative consequences for HSE, maintenance and PE have so far been identified.

Petoro reports emissions to the air and discharges to water from the portfolio in a separate section on the environment. The figures are taken from reporting by the operators to the Norwegian Oil and Gas Association and will be incorporated in the annual report at a later date, as soon as they become available.

Priority targets and activities in 2015

Mature fields

Petoro will contribute to good solutions for long-term field development and improved recovery from the mature fields in the SDFI portfolio, including measures for drilling more wells and more efficient drilling.

Petoro will work to reduce uncertainty in the reserve and resource base, and to identify associated well targets.

Petoro will direct its commitment towards projects for improved recovery from Snorre, Heidrun and Oseberg. These joint ventures face important decisions over the next few years on investment in new infrastructure which will contribute to improved recovery and reduce the risk of losing reserves.

Petoro has opted to combine its presentation of the initiatives and measures taken on these three goals, as well as the results achieved. Priority was given in 2015 to the mature Snorre, Heidrun and Oseberg fields, and the commitment to each of these is reported below.

Petoro’s commitment related to the mature fields aims to improve recovery from priority fields by choosing good solutions for long-term field development, drilling more wells per year, and drilling more efficiently.

The SDFI portfolio is dominated by large holdings in mature fields. In addition to the volumes covered by today’s plans, Petoro has identified more than 100 million scm in remaining reserves and additional resources with potential profitability in Snorre, Heidrun and Oseberg. Marginal profitability, time-criticality and investment requirements are factors which affect their realisation.

Petoro has long worked to clarify the reserve and resource base by mapping the remaining resource potential, and by identifying associated well targets so that field development decisions can be taken on the basis of realistic long-term plans in the licences. Efforts in the priority fields were as follows.

Snorre

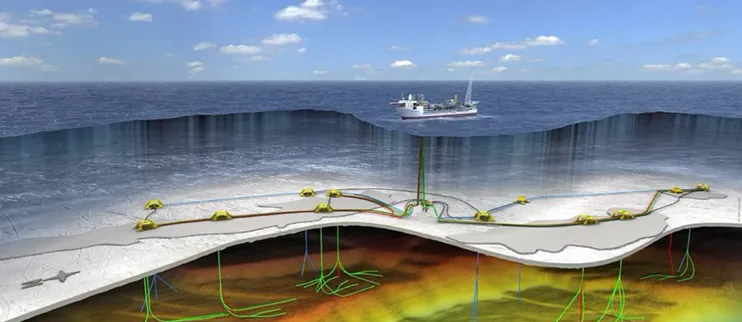

Petoro is an active driving force with the Snorre 2040 project, and contributed through its own work in 2015 to strengthening the reserve potential for a major new development solution. Challenging profitability prompted yet another postponement of the decision on continuation to the fourth quarter of 2016 and the introduction of a new concept based on subsea solutions as an alternative to a new Snorre C platform. Petoro has made its own assessments of the opportunities offered by a new concept for securing a realisation of the greatest possible value from further development of the field. Current plans call for an investment decision in 2017 and a start to production in 2021. The new solution makes it possible to realise Petoro’s ambition.

Heidrun

Through its own simulation studies as part of the decision gate 2 (DG2) phase for the Heidrun subsea extension project, Petoro has increased understanding of the reservoir in the northern parts of this field where the potential for improved recovery is greatest. This work has helped to reduced uncertainty and strengthen the reservoir potential for the Heidrun subsea extension, with a choice of concept planned for early 2017.

Oseberg

The contribution made by Petoro to Oseberg in 2015 was directed at improving the drainage strategy and ensuring robustness in the Oseberg future development project. A decision has been taken on a new simple and unstaffed wellhead platform as the first stage of the Oseberg Vestflanken 2 project. This innovative solution is entirely in line with Petoro’s view, and could open new opportunities for further field development. A plan for development and operation (PDO) was submitted in December 2015, with production planned to begin in 2018.

Through its own sub-surface work, Petoro assessed in 2015 whether an unstaffed wellhead platform is suitable as a concept for Oseberg Øst in order to improve the recovery factor to 40 per cent. This is a technically and financially demanding project with little support in the licence. Petoro’s work has nevertheless prompted the operator to initiate a project to look at alternative opportunities for increasing the number of wells and carrying out independent drilling from the platform. A choice of concept is planned in late 2016.

Field development

Petoro will contribute to the selection of good solutions for new field developments in the SDFI portfolio, such that these have sufficient flexibility to take care of new opportunities and lay the basis for long-term profitable production.

On the basis of its experience, Petoro has chosen to concentrate attention on flexibility in development solutions which allow future opportunities to be grasped, and on making provision for a long profitable producing life, quick and effective use of technological opportunities for improved recovery, reservoir descriptions and subsea processing.

Petoro devoted particular resources to following up Johan Sverdrup in 2015. See the separate report below.

Petoro will contribute to a good development of the Johan Sverdrup discovery, including unitisation.

Petoro’s commitment to Johan Sverdrup in 2015 was linked to an integrated development of the field and to ensuring robust procurement strategies for its first stage. The PDO for phase one was submitted in February 2015 with a development solution which, in line with Petoro’s view, lays the basis for good long-term value creation. Where future phases are concerned, an expansion of production capacity with a new platform at the field centre will provide the greatest long-term value creation. Petoro worked in 2015 to ensure that this structure will be as cost-effective as possible, and secured acceptance for further maturation of the concept up to DG2 in the autumn of 2016.

The company continued its own analysis work on the value potential of advanced improved recovery from Johan Sverdrup, and proposed solutions in this area. The licensees are planning a pilot project for such recovery after phase one has come on stream. Petoro has also sought to establish a robust basis for electricity supply capacity which ensures sufficient power in the long term.

Extensive work related to the unitisation of Johan Sverdrup was completed by Petoro during 2015, and a negotiated unitisation agreement was presented to the government for determination of the final terms in conjunction with the submission of the PDO in February 2015. The Ministry of Petroleum and Energy (MPE) decided on a division of Johan Sverdrup on 1 July 2015 which gave the SDFI a 17.36 per cent holding in the field.

Petoro will work to ensure early use of technology for improved recovery and good reservoir description.

The commitment to early use of improved recovery technology was directed in 2015 at Johan Sverdrup. Petoro concentrated its attention on maturing and facilitating the use of water-based injection techniques for enhanced oil recovery (EOR) from early in the field’s producing life. The company continued its own analyses of the potential and submitted solutions and a business case for this approach. The licensees are planning to implement an EOR pilot once phase one has come on stream. Petoro has also helped to ensure that EOR and water alternating gas (WAG) injection are incorporated as an integrated part of the development plans for phase two.

Where technology for reservoir description is concerned, Petoro continued its commitment on Johan Sverdrup to ensuring that permanent seismic sensors are installed. These cables are intended to monitor changes in the reservoir by repeatedly gathering seismic data during the production phase. That is important for improved well positioning in order to optimise oil recovery. This permanent reservoir monitoring approach has been adopted as the seismic technology method for the phase-one area of the field and will be installed by 2020 at the latest.

Far north – promoting coherent development

On the basis of the state’s participatory interests in Barents Sea South, Petoro will contribute to further development in this area with the emphasis on fields and discoveries such as Snøhvit and Johan Castberg.

In the far north, Petoro’s attention has been concentrated on the portfolio in Barents Sea South with the emphasis on Snøhvit, Johan Castberg and the Hoop area.

After many years of substantial operational and availability challenges and a strong concentration on measures to enhance robustness, production efficiency at the Snøhvit gas liquefaction plant now appears likely to be high in the future. Based on the existing Snøhvit wells, the field is expected to come off plateau in the early 2020s. Potential measures to extend plateau production were studied and assessed in 2015. Petoro has devoted particular attention to ensuring that the first of such measures is appropriate, and that the choice is viewed from an integrated and long-term perspective. Maturing and ranking/selecting plateau extension projects will continue in 2016, and this work indicates that it will be possible to maintain plateau production into the 2040s.

Where the Johan Castberg project is concerned, Petoro continued to focus during 2015 on improving profitability and enhancing the robustness of alternative concepts assessed by the licensees. A decision on continuation (DG2) was postponed in February 2015 to the third quarter of 2016, and the licensees opted in December 2015 for a production ship as the development concept. Petoro has contributed to ensuring that the chosen solution has sufficient processing capacity to provide tie-back opportunities for possible supplementary resources in the area.

A total of five exploration wells were completed in the Barents Sea during 2015. The SDFI participated in only one of these, the dry Bjaaland well in the OMV-operated Wisting licence (PL537). All four of the others were appraisal wells on the Alta discovery in PL609, operated by Lundin. A sixth exploration well was spudded, again in PL609 but further north in the licence (the Neiden prospect). This is an interesting prospect since it lies only 12 kilometres east of Johan Castberg. The well had to be temporarily plugged and abandoned since the rig was not winterised, and must be completed in 2016.

Monitoring Statoil’s marketing and sale of the government’s petroleum

Petoro will monitor that Statoil’s marketing and sale of the government’s petroleum together with its own production complies with the marketing and sale instruction given to Statoil ASA.

As part of its monitoring of Statoil’s marketing and sale, Petoro will:

- monitor the marketing and sale of the government’s petroleum, with attention being paid to the changed market conditions as well as to issues of great significance in terms of value or as matters of principle.

- assess whether the new formula for oil fulfils the goals which prompted the changes in 2011.

All oil and natural gas liquids (NGL) from the portfolio are sold to Statoil. The latter is responsible for marketing all the SDFI’s natural gas together with its own gas as a single portfolio, but at the government’s expense and risk. Petoro is responsible for monitoring that Statoil’s sales of the SDFI’s petroleum achieve the highest possible value, and for ensuring a rightful division of total value creation. Petoro concentrates in this work on Statoil’s marketing and sale strategy, issues of great significance in value terms, matters of principle and questions relating to incentives.

Petoro has given priority to evaluating the formulae for oil and NGL in order to assess whether the goals in the marketing and sale instruction concerning Statoil’s marketing and sale of the government’s oil and gas are met. The company has also prioritised work related to maximising value creation in the gas portfolio to ensure that available gas is sold in the market at the highest possible price and that the flexibility in the production facilities and transport capacity is exploited to optimise sales. Petoro has also devoted attention to the role of gas in Europe’s future energy mix, and has followed the development of EU energy and climate policies.

Checks were conducted to ensure that the SDFI was getting a rightful share of sales-related costs and revenues. Statoil and Petoro conducted a dialogue during the year concerning the establishment of a new system for following up their joint activities to improve the exercise of the companies’ role in relation to the marketing and sale instruction.

Petoro will describe how the organisation has prioritised its resources in order to address priority targets and assignments for 2015.

Major changes occurred in Petoro’s environment during 2015. After a long period of strong growth in oil prices and costs, the price of crude halved through the autumn of 2014. That created great uncertainty over future oil price trends and profitability.

The commitment to cost-cutting and enhancing efficiency increased during 2014 and 2015. Furthermore, the need for a rapid improvement in cash flow has been directed at reducing activity, cost/benefit assessment of measures, simplification and standardisation of solutions and work processes, improved planning and renegotiation of contract rates.

Current efficiency enhancements and initiatives to reduce the level of costs in the industry are crucial for improved profitability both in the immediate future and in the longer term. Greater emphasis on financial robustness challenges profitability and the choice of solutions in the projects. The scale and speed of this improvement work affects Petoro’s opportunities to realise the value potential in the portfolio with regard to both mature fields and possible new developments.

Petoro has had to revise its priorities swiftly and implement substantial adjustments as operators and the industry as a whole responded to the changes in their environment. A great deal of flexibility has been required from the company in order to adapt to rapid change related both to decisions in individual licences and to internal company and industry improvement measures.

To safeguard the assets in the SDFI portfolio within existing frameworks and resources, the company opted in the autumn of 2015 to concentrate on the following.

- Seek to continue minimising and managing major accident risk in relation to HSE.

- Continue to work as a driving force for reducing costs in order to secure profitable development and to ensure that durable reductions are achieved. Ensure that risk associated with improvement measures is understood and adequately managed.

- Identify time-critical resources and realise measures to improve profitable recovery from the mature fields.

- Pay special attention to boosting drilling efficiency, which is crucial for profitable drilling of wells on existing fields and new discoveries.

- Contribute to the choice of good and profitable solutions for new field developments, so that these are sufficiently flexible to take care of new opportunities and facilitate long-term profitable production.